89 – What to consider when calculating the benefits of alternative energy sources

Question

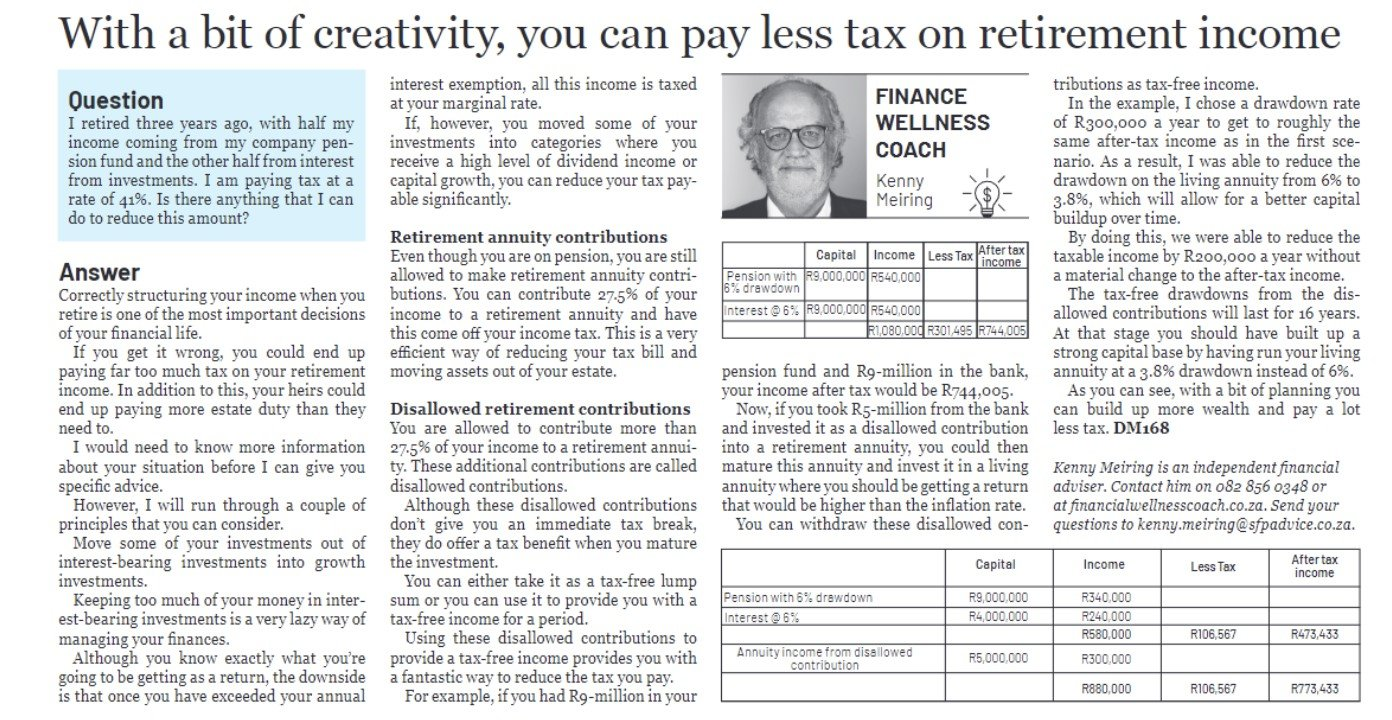

I retired three years ago, with half my income coming from my company pension fund and the other half from interest from investments. I am paying tax at a rate of 41%. Is there anything that I can do to reduce this amount?

Answer

When it comes to setting up alternative electrical supplies, there are two aspects to consider: convenience and investment. I cannot talk about the convenience aspect as each person’s tolerance level for electricity outages is different. What I can do is provide you with a basic model to evaluate whether installing alternative energy sources makes financial sense.

You do not want to be in a situation where it will take you too long to recoup your costs. You must establish how long it will take for the future savings you are going to make on your electricity bills to pay back the capital cost of the installation. I usually use a term of five years as a reasonable time frame for my calculations.

You need to do the following:

Establish the cost of the installation plus any maintenance costs over the next five years. These would be items such as replacement solar panels or batteries. Also, add in any financing costs if you are taking out a loan or using your bond. If you are taking the money out of your savings, remember to add in the lost interest or growth that you will not be getting.

Visit Daily Maverick’s home page for more news, analysis and investigations

Establish the monthly saving on your electricity bill that this will give you. Remember to factor in the annual Eskom increases, which are a lot higher than inflation. Divide the top number by the bottom number. If the result is less than 60, it means that the savings will have paid for the cost of the alternative energy supply in less than five years, so it is probably a good call.

Read on Daily Maverick: Residential solar power systems – Soaking up the sun is rewarding, but it isn’t all plain sailing

So, to answer your question, the solar geyser will cost you an effective R7,000. If you add in the financing costs, it will probably come to R10,000. If you are going to save R500 a month on your bill, then the pay-back time would be 10,000÷500 = 20, which means that the system would have paid for itself in less than two years. That makes it a good decision.

KENNY MEIRING IS AN INDEPENDENT FINANCIAL ADVISER

Contact him via phone, email or via contact phone on the financialwellnesscoach.co.za website

Read more of our articles on the Daily Maverick website or newspaper weekly!