117 – Should I sell my shares?

Question

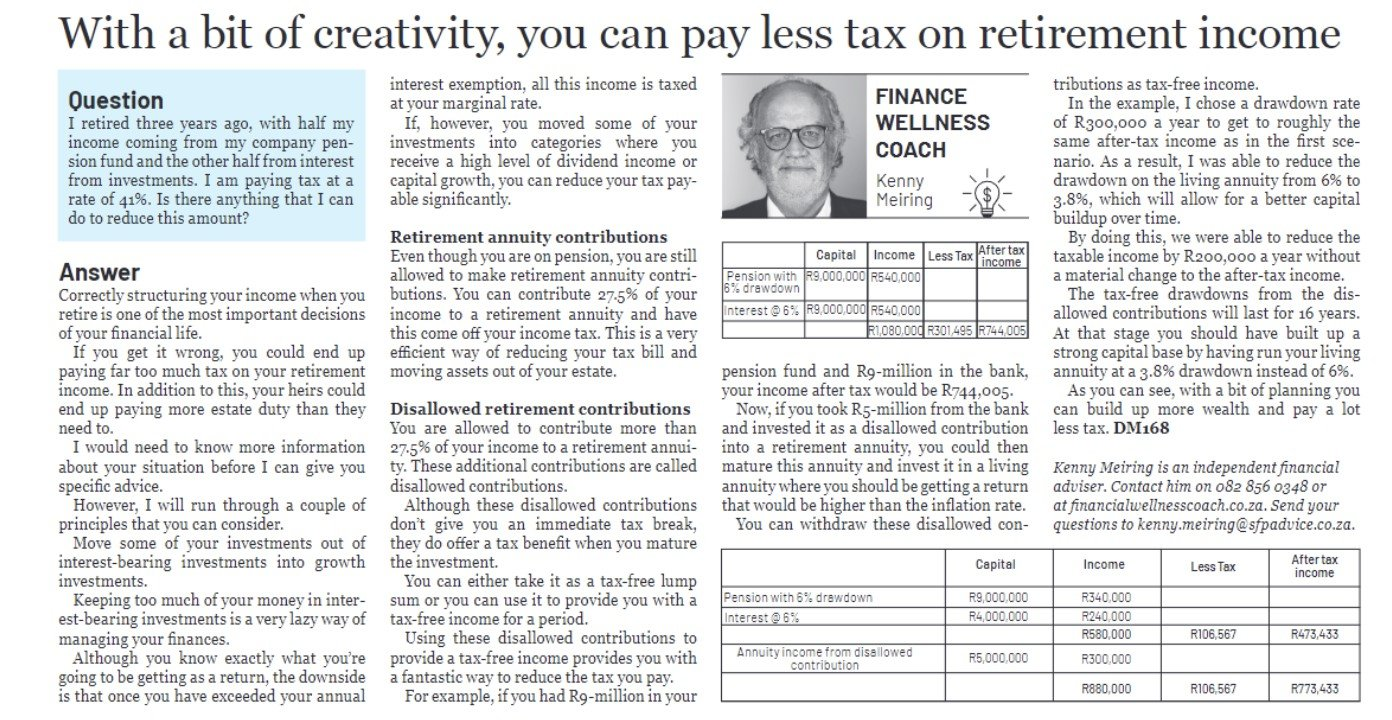

I retired three years ago, with half my income coming from my company pension fund and the other half from interest from investments. I am paying tax at a rate of 41%. Is there anything that I can do to reduce this amount?

Answer

It is difficult to give you a categorical answer without understanding your full financial situation. I will however go through a couple of factors that you should be considering when making this kind of decision.

Capital appreciation

The dividends that you get on a share are not the only issue you should be considering. You will also be getting some capital appreciation on the share price. With the bank deposit, you’ll just get your capital back once the interest has been paid.

Time frames

You must consider the time frame of any investment as well as the prevailing interest and inflation rates over the short and long term.

Seen in isolation, an interest rate of, say, 7.5% is great. However, when seen against the backdrop of an inflation rate of 7%, you will only be getting a return of inflation plus 0.5%. While this is great for a short-term investment, it is not ideal for a longer-term investment. I like to use this model:

|

Time Frame |

Targeted return |

|

Less than 2 years |

Money Market |

|

2 to 5 years |

Inflation + 3% |

|

More than 5 years |

Inflation + 5% |

Portfolio risk

By having R2m invested in just one share, you are running a concentration risk. If things go badly at that one company, your capital growth and dividend income will be affected. You can reduce this risk by investing in a portfolio that has assets in a range of different asset classes like equites, cash and property. This should allow form a more stable investment growth.

Tax on the income

The tax that you pay on dividends is 20% while the tax you’ll be paying on any interest income will be at your marginal rate once the annual tax allowance on interest has been breached.

If your income came from drawings from your portfolio, the only tax you’d be paying would be capital gains tax. This is 40% of your marginal tax. Even if your marginal tax rate is at the highest level of 45%, the CGT will only be 18% which is still lower than the dividend tax of 20%.

Capital Gains Tax (CGT)

When you sell your shares, it will trigger capital gains tax. As we are talking about a large portfolio, this amount could be high. I would recommend that you apply some thought to the selling process to ensure that you do not pay more tax than you need to.

Capital gains tax is calculated as follows:

Gain on the sale of the asset (less the annual R40 000 exclusion) x 40% x your marginal tax rate

If you spread the sale of the asset over a couple of years, you can take advantage of the annual exclusion where CGT only kicks in after you have had more than a R40 000 gain in that year.

The other option that you can use to reduce CGT is to reduce your marginal tax rate, This can be done by ensuring that you have invested the full 27.5% allowance into retirement savings.

As you can see, there are a number of moving parts to this question, and I would recommend that you chat with a competent financial planner who can help you make the correct decision.

KENNY MEIRING IS AN INDEPENDENT FINANCIAL ADVISER

Contact him via phone, email or via contact phone on the financialwellnesscoach.co.za website

Read more of our articles on the Daily Maverick website or newspaper weekly!