86 – How to keep your family financially stable during delays in winding up estates

Question

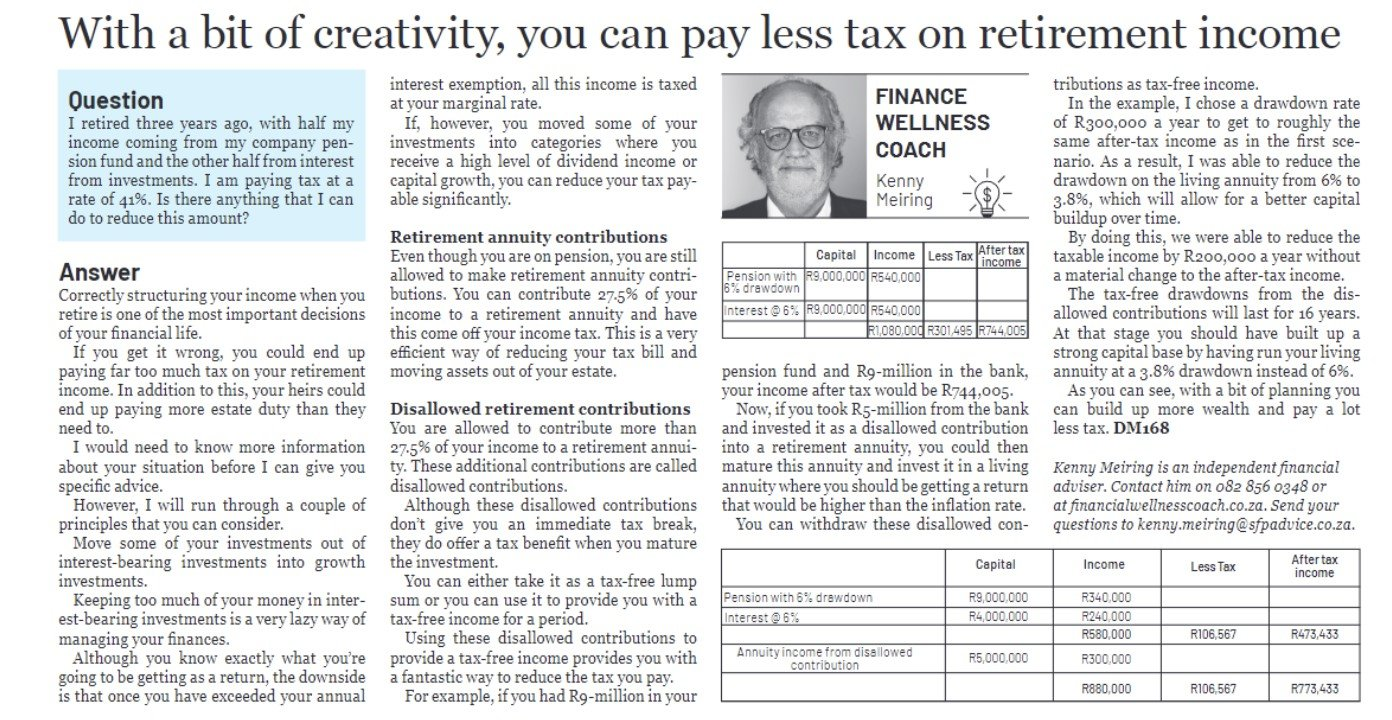

I retired three years ago, with half my income coming from my company pension fund and the other half from interest from investments. I am paying tax at a rate of 41%. Is there anything that I can do to reduce this amount?

Answer

I suspect that we are still suffering the consequences of Covid when it comes to the finalisation of estates. The increase in deaths and the challenges of working from home seem to have slowed the process.

When I do financial and estate planning, one of the factors that I take into account is access to funds. Your spouse and family need to have access to funds while your estate is being wound up. Here are some areas that I look at when I do this:

Attach beneficiaries

If you have any longer-term investments, you should put them into structures like endowments where you can attach a beneficiary. The beneficiary will typically have the proceeds within a month and not have to wait until the estate is wound up.

These investments will still attract estate duty, so it is prudent to keep aside 20% of the proceeds to pay this when the time comes.

Visit Daily Maverick’s home page for more news, analysis and investigations

Tidy up overseas investments

Overseas assets can delay the finalisation of an estate significantly, as your will would have to be sent to the country where the assets are. A grant of probate is then needed for your executor to be recognised in that country. This takes time and is costly.

If you have overseas investments you should consider putting them into a structure to which you can attach a beneficiary. This will remove the delays and costs of having to have a grant of probate registered.

Use living annuities cleverly

You can make your family members the beneficiaries of a living annuity. They will receive the proceeds in a lump sum or as a series of annuity payments. Living annuities funded from a pension or retirement annuity do not attract estate duty.

Insider tip

You are allowed to invest more than 27.5% of your income in a retirement annuity. Any tax break that is not used in the current year will be rolled over to subsequent years.

The excess contributions will be deemed an asset in your estate and will attract estate duty. However, if your beneficiary receives the proceeds of your retirement fund as an annuity, it will not attract estate duty.

KENNY MEIRING IS AN INDEPENDENT FINANCIAL ADVISER

Contact him via phone, email or via contact phone on the financialwellnesscoach.co.za website

Read more of our articles on the Daily Maverick website or newspaper weekly!