84 – How to create a viable succession plan and extract value from your practice

Question

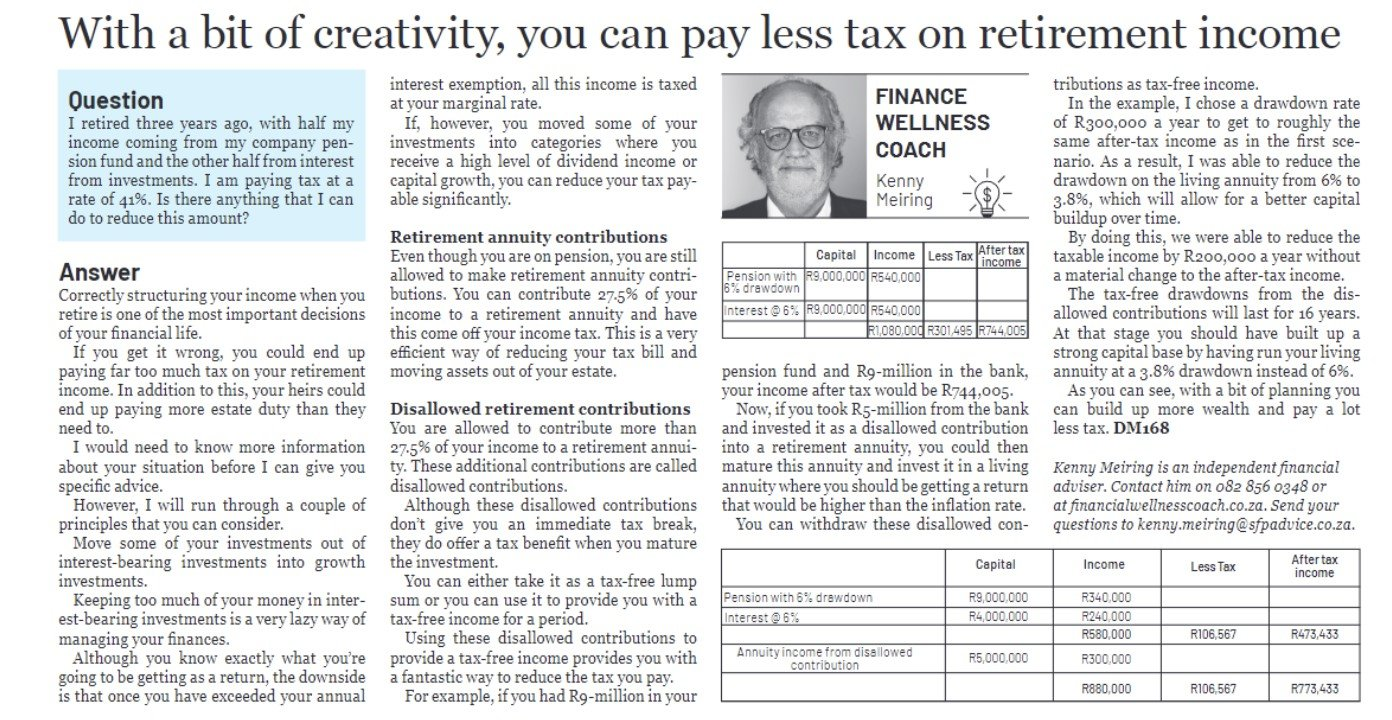

I retired three years ago, with half my income coming from my company pension fund and the other half from interest from investments. I am paying tax at a rate of 41%. Is there anything that I can do to reduce this amount?

Answer

Many professionals do not appreciate the true value of their practices, and when they retire or pass away the practice ceases to exist. If you set up the right structures ahead of time, you can create a viable succession plan and extract value from your practice. There are, however, a few things that need to be done to create a realistic exit plan:

- Have your practice valued.

- Set in motion a preferred compensation plan.

- Implement a will for your practice.

Have your practice valued

You need to determine the true worth of your practice. This should be done by an independent professional, using objective measures that can stand up to scrutiny and is fair to all parties. This sets the values used in the next steps.

Implement a preferred compensation plan

This is a structure that will keep the new person in your practice and enable him or her to buy out your shares.

I wrote about this structure in an earlier article and can forward you a copy should you need one.

It can also be found at this link

Implement a will for your practice

If you pass away before retirement, it is important that your successor be in a financial position to buy out your share of the practice. To do this, we set up what is called a one-sided buy and sell agreement.

Here your successor enters into an agreement to acquire your share in the practice. This would be funded by a life policy that pays out to your successor with the accompanying requirement to buy your share of the practice.

I would recommend that you talk to a suitably qualified and experienced financial adviser who can structure a realistic and workable plan.

This would have all the necessary terms and conditions to protect all parties. It would also set out timelines and financial outcomes in detail.

A well-constructed exit plan will enable you to extract the full value from your practice, should you pass away or retire.

KENNY MEIRING IS AN INDEPENDENT FINANCIAL ADVISER

Contact him via phone, email or via contact phone on the financialwellnesscoach.co.za website

Read more of our articles on the Daily Maverick website or newspaper weekly!