91 – A shareholder buy-and-sell arrangement can preserve your business dynamic

Question

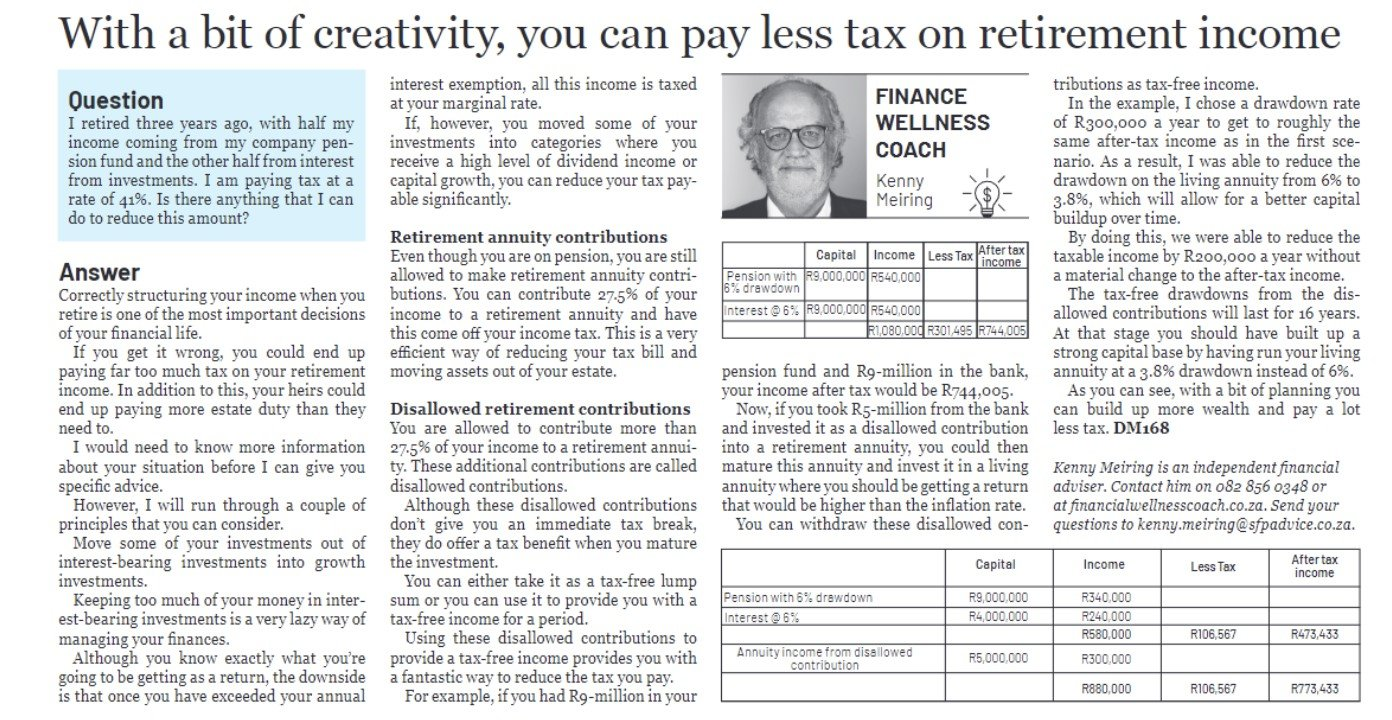

I retired three years ago, with half my income coming from my company pension fund and the other half from interest from investments. I am paying tax at a rate of 41%. Is there anything that I can do to reduce this amount?

Answer

The death of a major shareholder of a business can cause major problems for a business if you do not have a pre-agreed plan in place. A buy-and-sell arrangement is such a plan.

Should your partner die, his share of the business would be an asset in his estate. If he bequeaths his assets to his spouse, the spouse would in effect take over his position in the company.

I have found that, in most instances, the spouse has neither the inclination nor the ability to effectively take over.

A neater solution would be for the spouse to receive a cash payout for the share of the business and have the surviving directors take over the shareholding. To do this, you need to put a buy-and-sell arrangement in place.

There are two elements to a buy-and-sell arrangement.

A contract between the shareholders of the business

In this contract, the shareholders of the business entity agree that should they die, they would sell their interest in the business to the surviving directors.

A value of the business would be calculated at the time of the contract and would be revised regularly. This also ensures that the family of the deceased understand what they are entitled to before a death occurs.

Life insurance policies on the lives of the directors

Life insurance policies would be taken out on the lives of each director, with the sum insured equal to that director’s share of the value of the business.

Should a director die, the policy would provide the funding for the fellow directors to buy out the deceased’s share of the business.

Advantages

The advantage of a buy-and-sell structure is that business disruptions are minimised when a director dies and the business dynamic is preserved.

Payouts can also be made in the event of disability, and you can also structure these arrangements to repay any loan accounts that the directors may have.

Buy-and-sell arrangements can work for any type of business form, including trusts, partnerships and close corporations.

So, to answer your question, you should put a buy-and-sell arrangement in place for both yourself and your fellow director.

Just as your personal will directs how your personal assets should be dealt with, the buy-and-sell arrangement will direct how your company assets should be dealt with.

This is a very brief summary of what is a complex topic with lots of potential pitfalls.

For example, it is vital that the premiums are paid by those who are needing to buy the shares. If they are paid by the company or the life insured, there will be serious tax consequences.

Please talk to a knowledgeable financial adviser who is aware of the various tax and estate duty implications of these structures.

KENNY MEIRING IS AN INDEPENDENT FINANCIAL ADVISER

Contact him via phone, email or via contact phone on the financialwellnesscoach.co.za website

Read more of our articles on the Daily Maverick website or newspaper weekly!