90 – The pros and cons of investing funds offshore

Question

I retired three years ago, with half my income coming from my company pension fund and the other half from interest from investments. I am paying tax at a rate of 41%. Is there anything that I can do to reduce this amount?

Answer

It is easy to invest funds offshore. Your financial adviser or a currency specialist can convert your rands into dollars very quickly. Each individual is allowed to take R1-million offshore each year with relative ease. This is usually referred to as your travel allowance. In addition to this, if your income tax affairs are in order, you can take a further R10-million overseas each year.

The next question is, what should you do with this money once it is offshore?

Many people leave their money in a bank. This is not always the wisest course of action, as overseas bank rates are very low. There may be merit in investing in some growth assets.

Despite their poor performance this year, global equities – when converted to rands – have been the best-performing asset class over the past five, 10 and 15 years, as can be seen in Table 1.

Besides not providing you with inflation-beating returns, an offshore bank deposit will incur a lot of unnecessary costs and complicate the wrapping up of your estate at the time of death.

I usually recommend that people invest their offshore assets in an offshore wrapper such as a global endowment. As you can attach a beneficiary to it, you do not have to deal with the hassles of probate.

Also, even though the investment is housed offshore, it is deemed to be an asset in your South African estate, so you only have to pay South African estate duties rather than the potentially higher offshore death duties.

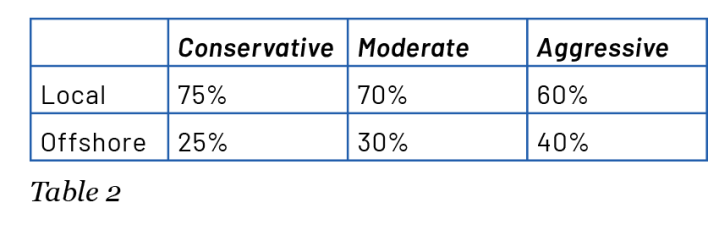

In terms of the proportion of assets you should have offshore, a model that I often use is seen in Table 2.

If you are a conservative investor, you should have 25% of your assets offshore, and, if you are aggressive, you could go up to 40%.

I would recommend that you chat to your financial adviser about how to go about reducing the risk of having all your assets in one country.

KENNY MEIRING IS AN INDEPENDENT FINANCIAL ADVISER

Contact him via phone, email or via contact phone on the financialwellnesscoach.co.za website

Read more of our articles on the Daily Maverick website or newspaper weekly!