101 – How to choose the right medical product

Question

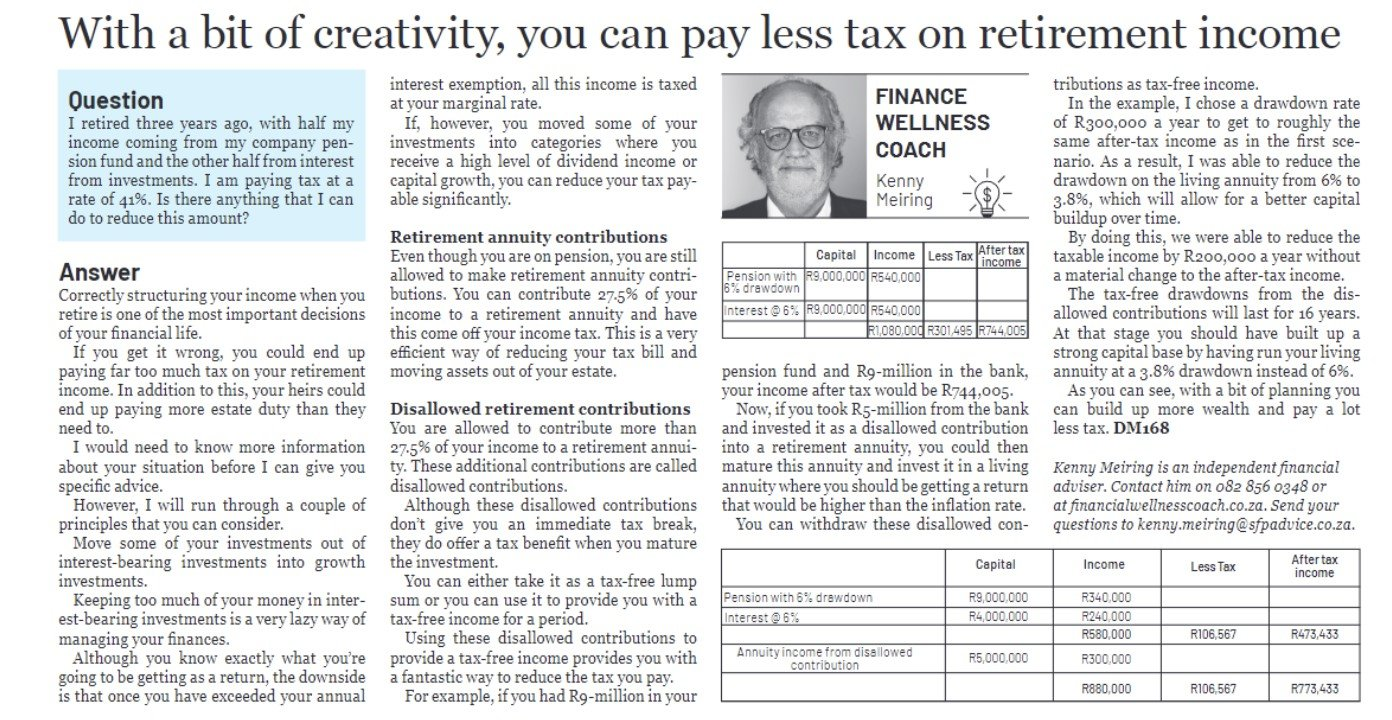

I retired three years ago, with half my income coming from my company pension fund and the other half from interest from investments. I am paying tax at a rate of 41%. Is there anything that I can do to reduce this amount?

Answer

Each of these products is designed to meet a particular need, so you will probably need all of them. However, the amount of cover that you need from each of them will be determined by your own personal circumstances.

I will go through how each product works in order to help you understand how these could fit into your personal situation. There are many different products in the market, and each has different bells, whistles and nuances. As a result, what I say may not hold true for all products.

Medical aid gap cover

This benefit typically kicks in when you are in hospital and usually pays the difference between what your doctor and hospital charge and what the medical aid pays.

There are two things to watch out for.

- If your medical aid does not pay for a treatment, it is unlikely that your gap cover will pay you out anything.

- You generally need to be in hospital for the gap cover to pay out anything. Out-of-hospital expenses and follow-up visits would typically be for your own account and this could be quite costly.

Sickness benefit

This benefit typically pays you a percentage of your salary if you are ill for an extended period. The sickness benefit usually has a maximum term of two years, after which there is often an income protector benefit that would pay you your salary till you reach retirement age.

There are usually waiting periods before a sickness benefit pays out. These can range from seven days to six months. The shorter the waiting period, the more expensive the premiums would be.

Critical illness cover

This pays out a rand amount should a major health event like a heart attack or cancer diagnosis take place. This is an extremely useful benefit as it fills in a lot of the gaps that one can experience should a medical event happen. These would include:

- Paying for out-of-hospital treatments;

- Providing you with funds to live on during the waiting period on your sickness benefit; and

- Paying for any self-payment gap on your medical aid.

As we get older, the likelihood of us suffering from a critical illness increases. The problem is that when we are on pension, our budgets are very tight and a medical incident can cause serious financial problems.

Insider tip

Many people have critical illness cover as part of their company group benefits. The problem is that when you retire, you lose this cover. As the likelihood of claiming increases as you get older, I usually recommend to my clients that they take out additional cover that will last for the whole of their lives.

As you can see, each of these benefits provides part of a solution to any financial stress that you may experience should you be ill. A decent financial adviser will be able to assist you in putting together the right combination of these benefits which will provide you with the necessary protection at the best possible price.

KENNY MEIRING IS AN INDEPENDENT FINANCIAL ADVISER

Contact him via phone, email or via contact phone on the financialwellnesscoach.co.za website

Read more of our articles on the Daily Maverick website or newspaper weekly!