111 – What lump sum should you take from your retirement fund

Question

I will be retiring soon and am entitled to take a lump sum of R2 million from our pension fund. I believe that we can take a lower lump sum in order to get a higher pension. What would you recommend that I do.

Answer

Deciding on what lump sum you should be taking is a complex decision as there are a number of moving parts. The good news is that all retirement funds are obliged by law to provide retirement benefit counseling. Your retirement fund counselor should be able to help you get to the right solution.

I will take you through a couple of the issues that I typically consider when I counsel retirement fund members:

Tax

The retirement lump sums are taxed on a sliding scale:

|

Lump Sum |

tax rate |

|

R0 – R550 000 |

0% |

|

R550 001 – R770 000 |

18% |

|

R770 001 – R1 155 000 |

27% |

|

R1 155 001 + |

36% |

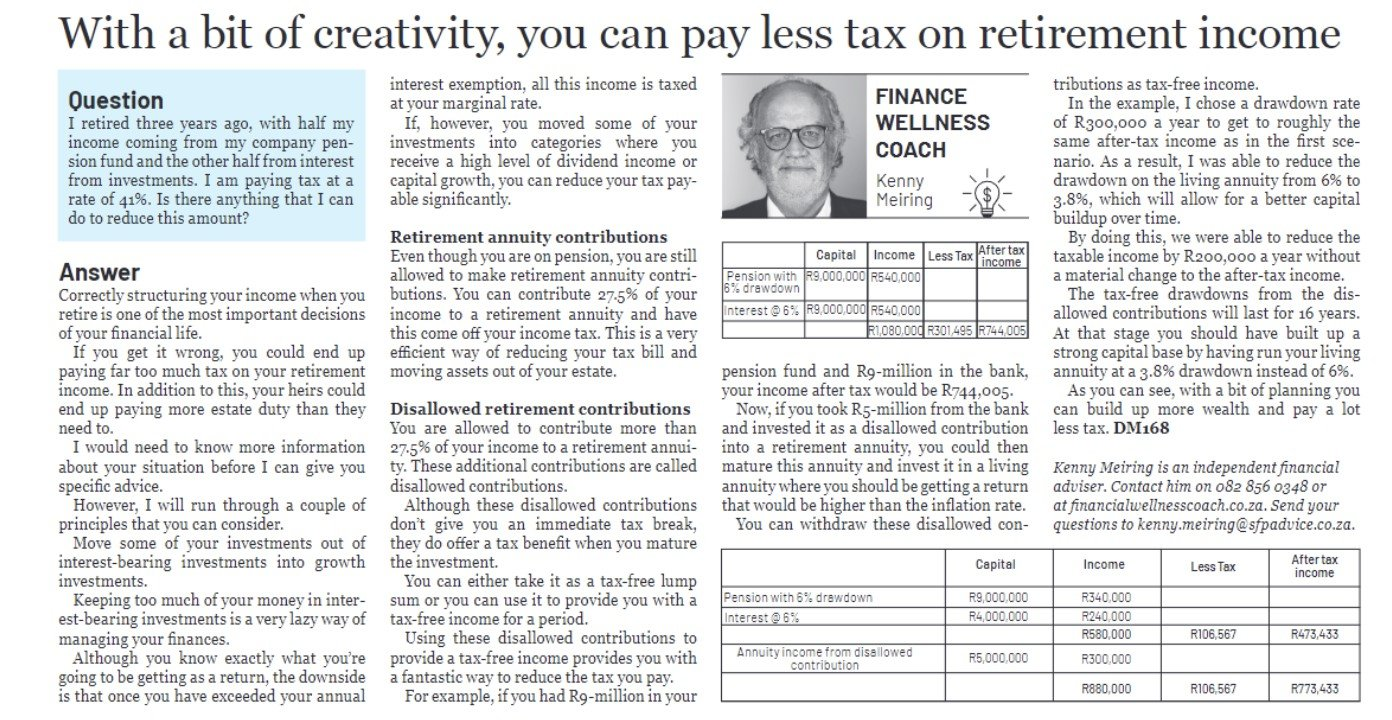

If you took the full R2 000 000 as a lump sum, you would pay R447 750 in tax and receive R 1 552 250 after tax as can be seen below

|

Lump Sum |

Amount |

tax rate |

Tax Payable |

Net Amount |

|

R0 – R550 000 |

R550,000 |

0% |

R0 |

R550,000 |

|

R550 001 – R770 000 |

R220,000 |

18% |

R39,600 |

R180,400 |

|

R770 001 – R1 155 000 |

R385,000 |

27% |

R103,950 |

R281,050 |

|

R1 155 001 + |

R845,000 |

36% |

R304,200 |

R540,800 |

|

R2,000,000 |

R447,750 |

R1,552,250 |

Alternatively, if you took R1 155 000, as a lump sum you would pay R143 550 in tax and if you took R550 000 as a lump sum you would pay no tax at all.

The challenge is to find the sweet spot where you get the right lump sum while not paying too much tax. To do this, you need to determine what your marginal tax rate will be when you retire. You should ideally not take a lump sum amount where lump sum tax band is higher than the marginal tax that you would be paying when you retire.

For most people I recommend that they take the R550 000 which is tax free and then increase the lump sum till they reach their marginal tax rate.

Why take a lump sum?

There are two main reasons why you should take a lump sum.

Emergency fund

When you retire, you will need to make provision for those out of the ordinary costs like a major car repair or medical expenses. Having an emergency fund will provide the right kind of buffer. If you do not have savings that you can access in an emergency, your retirement lump sum will be a way to create this fund.

It is important that you actually invest this emergency fund properly and don’t just leave it in a low interest savings account. My standard approach here is to use my three-pot system where you have money that you intend using over the next year in the bank and invest the balance in growth assets which are easily accessible.

Tax saving

If you already have an emergency fund in place, you can invest your lump sum to get an income. The benefit here is that the only tax that you will be paying will be capital gains tax which is significantly lower than your income tax.

For example, if your tax rate is 31%, you would pay R310 in tax on an income of R1 000 from a pension. If this income came from an investment that you made with your lump sum, you would only pay R124 in tax.

As you can see, determining what lump sum you should take when you retire is not a simple decision. It is therefore vital that you get as specialist to help you make the right choice.

KENNY MEIRING IS AN INDEPENDENT FINANCIAL ADVISER

Contact him via phone, email or via contact phone on the financialwellnesscoach.co.za website

Read more of our articles on the Daily Maverick website or newspaper weekly!